You should be saving 20-25% of your gross income toward retirement. Keep in mind, the more time your money has to grow, the more powerful it is.

We suggest saving 20-25% of your gross income towards retirement. While saving something is better than nothing, especially while you're young or just starting out, this 20-25% savings rate should be your goal.

The higher your income, the more your retirement lies on your shoulders.

As of 2021, the average monthly Social Security benefit is just $1,514 per month. A little over $1,500 per month may be enough to survive, but it is not enough to travel, dine out, or give gifts to children and grandchildren.

The good news?

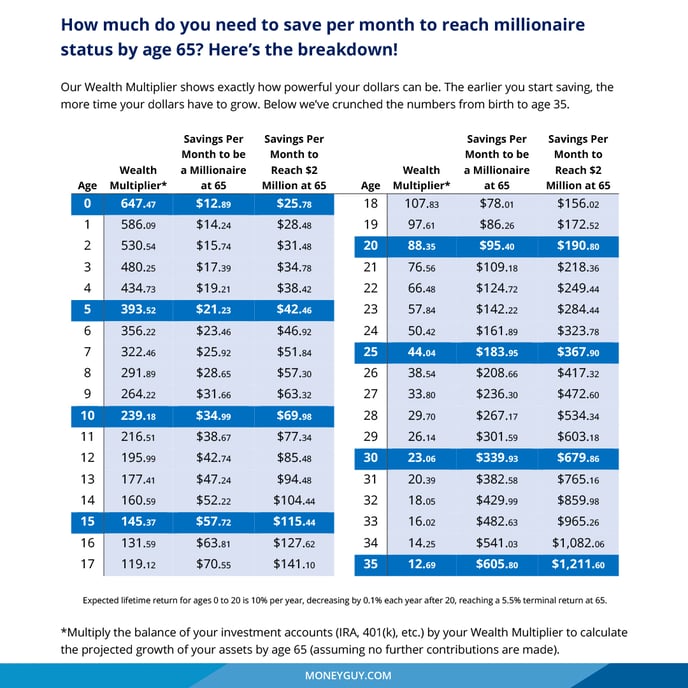

If you start young, you have the potential to build significant wealth and set yourself up for a successful and meaningful retirement. Saving just $95 per month starting at age 20 will grow into $1,000,000 by the time you turn 65. This is the power of compounding interest.

To find out how much money you need to save to reach $1,000,000 (or more) download our free resources:

- How Powerful Are Your Dollars?

- Wealth Multiplier for Young Savers

- Are You on Track to Be a Millionaire?

For more details on the power of compounding interest and our suggest 20-25% savings rate, check out the following videos.

Average Net Worthy By Age in 2021! (Full Episode -57:23)

Is Saving 15% for Retirement Like Dave Ramsey Suggests Enough? (Highlight - 9:00)